- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, May 7, 2019 @ 12:20 am

Breakthroughs, scientific or medical, can transform industries, especially in an environment as dynamic as biotech. To take full advantage of the opportunities, you have to be prepared, and you must have the flexibility to change established procedures, business models and regulatory frameworks.

Jan Lucht

scienceindustries

Around 500 BC, Heraclitus declared, “the only thing that is constant is change”. Outcomes of change very much depend on how one deals with them and whether the focus is on potential threats or the opportunities: “When the wind of change blows, some build walls while others build windmills” (Chinese proverb). It takes courage, determination and a long-term strategy to take full advantage of change and build ‘windmills’ instead of ‘walls’.

Cell-based immunotherapy challenges

Biotechnology has been highly successful in providing new treatments for serious health conditions and for improving patients’ quality of life. For 2019, it is predicted that eight of the top ten best-selling pharma compounds worldwide will be biotech products. Most of them are monoclonal antibodies for cancer therapy. While the availability of these has allowed great progress in the treatment of specific tumors, the effectiveness of antibody therapy for other types of cancer is limited.

Very recently, a completely new class of treatments for neoplastic diseases became available: cell-based immunotherapy, and specifically chimeric antigen receptor T-cell (CAR-T) therapy. This new approach to cancer treatment has a huge medical potential but also presents a variety of challenges for pharma companies. Regulations, the production process and delivering the treatment to patients, all require major changes to established practices. This is illustrated by Kymriah®, a groundbreaking, novel cancer therapy developed by Novartis.

Immunotherapy harnesses the body's own defense systems to combat cancer. For CAR-T therapy, some of the patient's T-cells are removed, genetically modified in the lab (to be able to recognize and attack the patient's tumor), multiplied, and then re-infused into the patient. The results have been remarkable: many seriously ill patients have improved dramatically with their cancer going into remission or disappearing. This is a breakthrough for the treatment of serious, life-threatening diseases, where previously there were only very limited treatment options.

Much of the ground-breaking work for CAR-T cell therapy was done at the University of Pennsylvania. In 2012, Novartis partnered with UPenn and pushed on to make the therapy available to patients as soon as possible. Very positive results from clinical studies and a good collaboration with regulatory agencies helped guide the treatment through the authorization process, even though this was a treatment with no direct precedent.

In August 2017, Novartis obtained first-in class authorization in the US for Kymriah®, the CAR-T based therapy for treatment of B-cell acute lymphoblastic leukemia in young patients. The indication was subsequently expanded to include diffuse large Bcell lymphoma in adults. Marketing authorization for the EU and Switzerland followed in 2018.

The CAR-T cells are prepared individually for each patient using a highly technical process requiring expertise and specialized equipment. The treatment of the patients takes place in dedicated medical centers. This meant that new manufacturing and supply chain systems that deviated significantly from those used for traditional off-the-shelf drugs had to be set up. Kymriah® is unlike a classical pill that can be produced in large numbers at a few sites and much more like a very personalized service.

The labor-intensive preparation of each individual patient's CAR-T cells, the complex cooperation involved, and the small number of patients with an indication for Kymriah® treatment, means that the costs of the single infusion required for the treatment appears to be very high – especially when compared with the single doses of more traditional drugs that are given repeatedly over a longer course of time. This has led to discussions about the pricing of short-time treatments, including cell-based immunotherapies that result in long-lasting or permanent benefit.

In comparison to traditional approaches like stem-cell transplantation from a matching donor, the highly efficient and potentially curative CAR-T treatment is cost-effective. In the long run, pharma companies and the healthcare system will have to find a new approach to compensation. This would also take into account the value of a given treatment for the patient and might include outcome-based pricing models where payment is linked to the success of a therapy.

For healthcare biotechnology companies, the medical breakthrough of CAR-T cancer therapy required many changes including authorization, business model, logistics and healthcare financing. The continuing willingness of all actors to change established practices and adapt them to new developments will play an important part in realizing the huge potential of immunotherapy to transform cancer care.

Novartis is currently expanding its network of production sites in Europe, including a CHF 90 million investment in Switzerland to build an ultramodern production site for innovative cell and gene therapies in Stein (AG), with a potential of up to 450 highly qualified jobs. The first batches of Kymriah® from Stein will likely be available in 2020.

Changes to genome editing regulations

Recently developed tools for genome editing, like CRISPR/Cas9, have given a boost to research and product development in all sectors of the biotech industry. Applications are wide-ranging: improvement of production strains for industrial biotechnology, more resistant and sustainable crop plants in agricultural biotechnology, and new cures for disease and the production of optimized active compounds in healthcare biotechnology. However, the regulatory framework has not kept pace with the rapid scientific progress.

The European Commission has been aware of these developments for over a decade but has repeatedly postponed adapting the quarter-century old EU regulations governing genetic engineering techniques. This lack of action resulted in the controversial decision by the European Court of Justice in the summer of 2018. Based on the antiquated EU regulations, it classified all organisms resulting from genome editing, irrespective of the introduced changes, as ‘genetically modified organisms’ (GMO) and thereby subjected them to strict authorization and labeling requirements. This decision means that for the EU, genome editing has been removed from the toolbox in some biotechnology sectors like plant breeding, and research and development has been paralyzed for years to come.

In Switzerland, the government realized the need for action and in November 2018 announced a plan to adapt the regulatory framework to the newly available technologies. Genetic changes in organisms should be classified according to different risk levels, with different requirements. This opens the possibility for the development of flexible, proportionate, and sciencebased, future-proof rules for genetic engineering technologies in Switzerland. Here, a willingness to change the regulation will benefit the Swiss biotech sector in general and could also give an impulse to the gridlocked situation in the rest of Europe.

Major contribution to Swiss exports

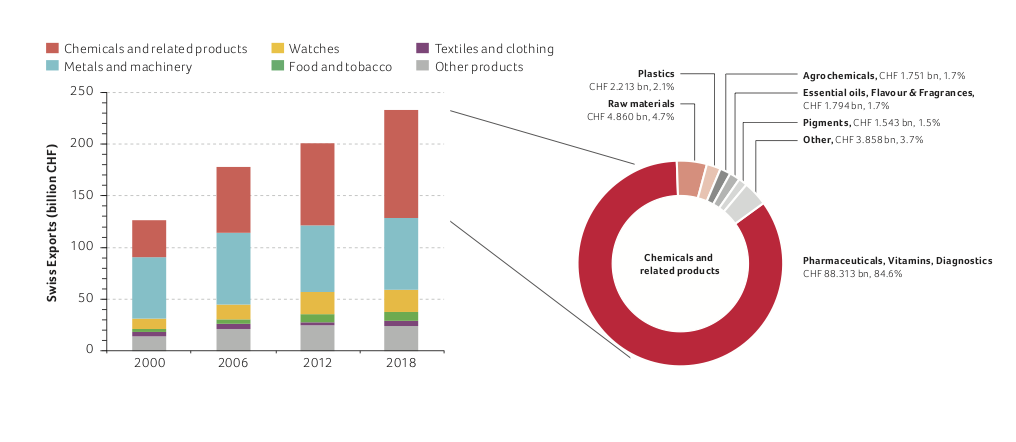

Favorable framework conditions in Switzerland, including a highly qualified workforce, a stable economic and political system and a good network comprising research institutes, companies and government institutions have supported strong economic development. In 2018, exports from the Swiss chemistry, pharma and life sciences sector, including biotech products, reached a record high of CHF 104.3 billion.

This sector's share of total exports has steadily increased from 28% in 2000 to 45% in 2018. Since 2009, it has been Switzerland’s largest export industry (see figure below). Swiss exports from all sectors have increased by 84% since the year 2000 to reach CHF 233.1 billion in 2018. Over the same period, the contribution of the life sciences subsector (pharmaceuticals, vitamins and diagnostics, with a significant proportion of biopharmaceuticals and biotech products) quadrupled from CHF 22.1 billion to CHF 88.3 billion. This demonstrates the strong dynamics of the life sciences sector.

Compared to the previous year, the life science sector exports grew by 5% and now contribute 85% of the total exports of the chemistry, pharma and life sciences industry, and 38% of the total Swiss exports.

scienceindustries – the Swiss Business Association Chemistry Pharma Life Sciences scienceindustries supports some 250 member companies: fostering an innovation-friendly environment in Switzerland, creating a competitive production and business framework, enabling attractive market conditions, and facilitating worldwide market access. For more information visit www.scienceindustries.ch.